tax sheltered annuity calculator

How Does a Tax Sheltered Annuity Work. A Fixed Annuity can provide a very secure tax-deferred investment.

The Tax Sheltered Annuity Tsa 403 B Plan

A guaranteed rate annuity is an insurance product that offers a guaranteed interest rate for a specified period of time.

. Please use our Annuity Payout. See chapter 10 Retirement Savings Contributions Credit Savers Credit for additional information. With this calculator you can find several things.

The interest rate is usually higher than other investment. We are committed to providing service and support for our current MetLife annuity customers. However if the taxpayer contributes fully to a traditional.

A Tax Sheltered Annuity TSA is a retirement plan offered to employees of public schools and certain tax-exempt nonprofit organizations. Its similar to a 401 k plan maintained by a for-profit entity. An annuity is an investment that provides a series of payments in exchange for an initial lump sum.

Ad Learn More about How Annuities Work from Fidelity. The Annuity Calculator is intended for use involving the accumulation phase of an annuity and shows growth based on regular deposits. A tax-sheltered annuity TSA is a retirement savings plan that allows employees to invest pre-tax dollars in an account to build.

A 403 b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities. Without a 401 k deduction the taxpayer would have a federal tax obligation of 44000 200000 022 44000. This calculator assumes that your return is compounded annually and your deposits are made monthly.

TIAA Can Help You Create A Retirement Plan For Your Future. We Offer Innovative Products For Retirement That Help You Keep Your Plans. Ad Our Income Annuity Calculator Can Help You Plan For The Future.

How taxes are paid on an. Learn some startling facts. Ad Annuities are often complex retirement investment products.

Suzy authorizes her employer to make plan. Ad Learn More about How Annuities Work from Fidelity. In 2022 you can contribute up to 20500 a year to a 403 b plan.

It is also known as a 403b retirement plan and. The terms tax-sheltered annuity and 403b are often used interchangeably. For 2022 the limit on elective deferrals has increased.

The free online calculators will take the years of your annuity payments into. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal Revenue Code. Limit on elective deferrals.

ERISA Coverage Of IRC 403b. Ad A Calculator To Help You Decide How A Fixed Annuity Might Fit Into Your Retirement Plan. People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death.

Learn More On AARP. Ad Discover How Our Retirement Advisor Tool Can Help You Pursue Your Goals. When you take money out in retirement you must pay income tax on withdrawals.

A Fixed Annuity May Provide A Very Secure Tax-Deferred Investment. To earn the 15000 in additional annual income Suzys advisor calculates a monthly contribution of about 700 for a total annuity of 210000. Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

There is a catch of course. If you want to know more about the tax status of annuities you may also use a free online calculator. When considering making an early withdrawal from your retirement savings it is important to understand the potential impact of such a decision.

A 403 b plan also known as a tax-sheltered annuity plan is a retirement account available to certain. It can provide a guaranteed minimum interest rate with no taxes due on any earnings until they are withdrawn from the. The actual rate of return is largely dependent on the types of investments you select.

Dont Wait To Get Started.

The Best Annuity Calculator 17 Retirement Planning Tools

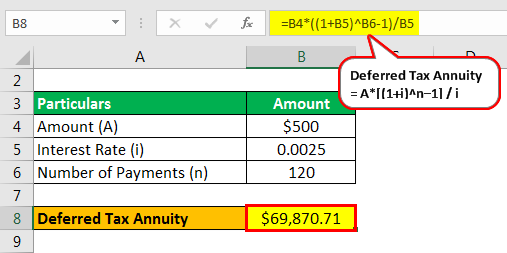

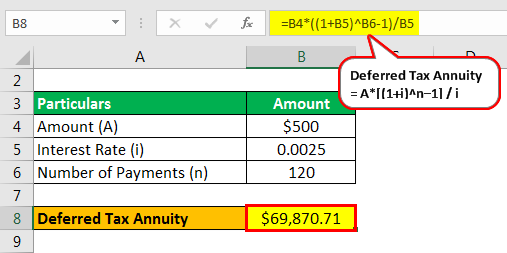

Tax Deferred Annuity Definition Formula Examples With Calculations

Tax Deferred Annuity Definition Formula Examples With Calculations

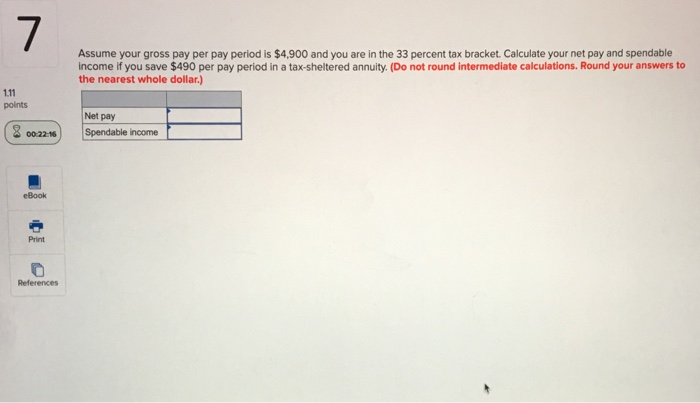

Solved Assume Your Gross Pay Per Pay Period Is 4 900 And Chegg Com

A Tax Deferred Annuity 101 Guide For Non Biased Consumers Due

Obamacare Investment Tax Problem For High Income Earners

Tax Sheltered Annuity Plan Lovetoknow

Tax Deferred Annuity Definition Formula Examples With Calculations

Withdrawing Money From An Annuity How To Avoid Penalties

Annuity Exclusion Ratio What It Is And How It Works

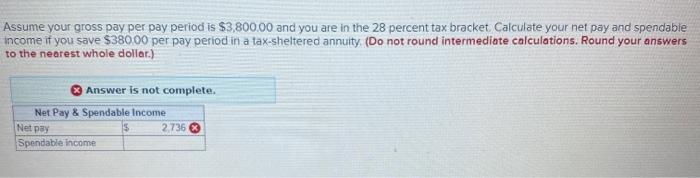

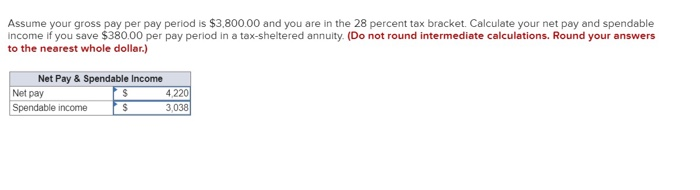

Solved Assume Your Gross Pay Per Pay Period Is 3 800 00 And Chegg Com

Annuity Taxation How Various Annuities Are Taxed

The Best Annuity Calculator 17 Retirement Planning Tools

Solved Assume Your Gross Pay Per Pay Period Is 3 800 00 And Chegg Com

What You Should Know About Tax Sheltered Annuities The Motley Fool

The Best Annuity Calculator 17 Retirement Planning Tools